The Current State of the M&A Market

Between Challenges and Opportunities

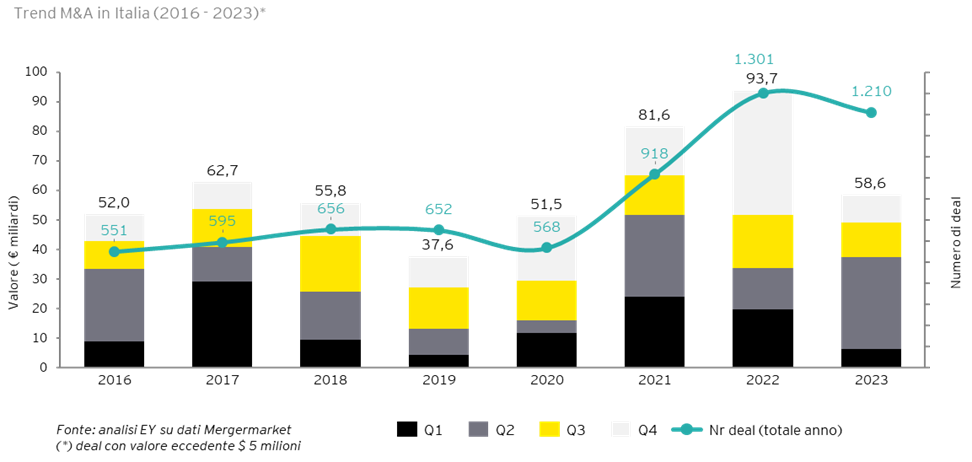

In recent years, the mergers and acquisitions (M&A) market has undergone profound transformations, influenced by economic, geopolitical, and technological factors. Following the surge of 2021—a record-breaking year for deal volume and value—2023 experienced a slowdown, driven by uncertainty stemming from inflation, high interest rates, and global geopolitical tensions.

The global economic landscape of 2023 saw a general decline in M&A activity compared to the peaks of previous years. However, sectors such as technology, renewable energy, and healthcare maintained high levels of activity, supported by strong demand and continued capital availability.

Key Emerging Trends:

- Focus on Sustainability:Increasingly, companies are pursuing deals aligned with ESG (Environmental, Social, Governance) criteria, responding to growing pressure from investors and consumers.

- Sector Consolidation:Fragmented sectors like retail and e-commerce are experiencing an accelerated push toward integration.

- Innovative Technologies:The race to acquire tech startups has become a critical strategy for staying competitive in a rapidly evolving digital landscape.

Despite the challenges, the M&A market remains a key driver of global corporate growth. The combination of operational flexibility, strategic vision, and technical expertise will be crucial to seizing future opportunities. M&A transactions not only address economic pressures but also act as a catalyst for innovation and long-term strategic positioning.

WA